- Biweekly Pay Schedule

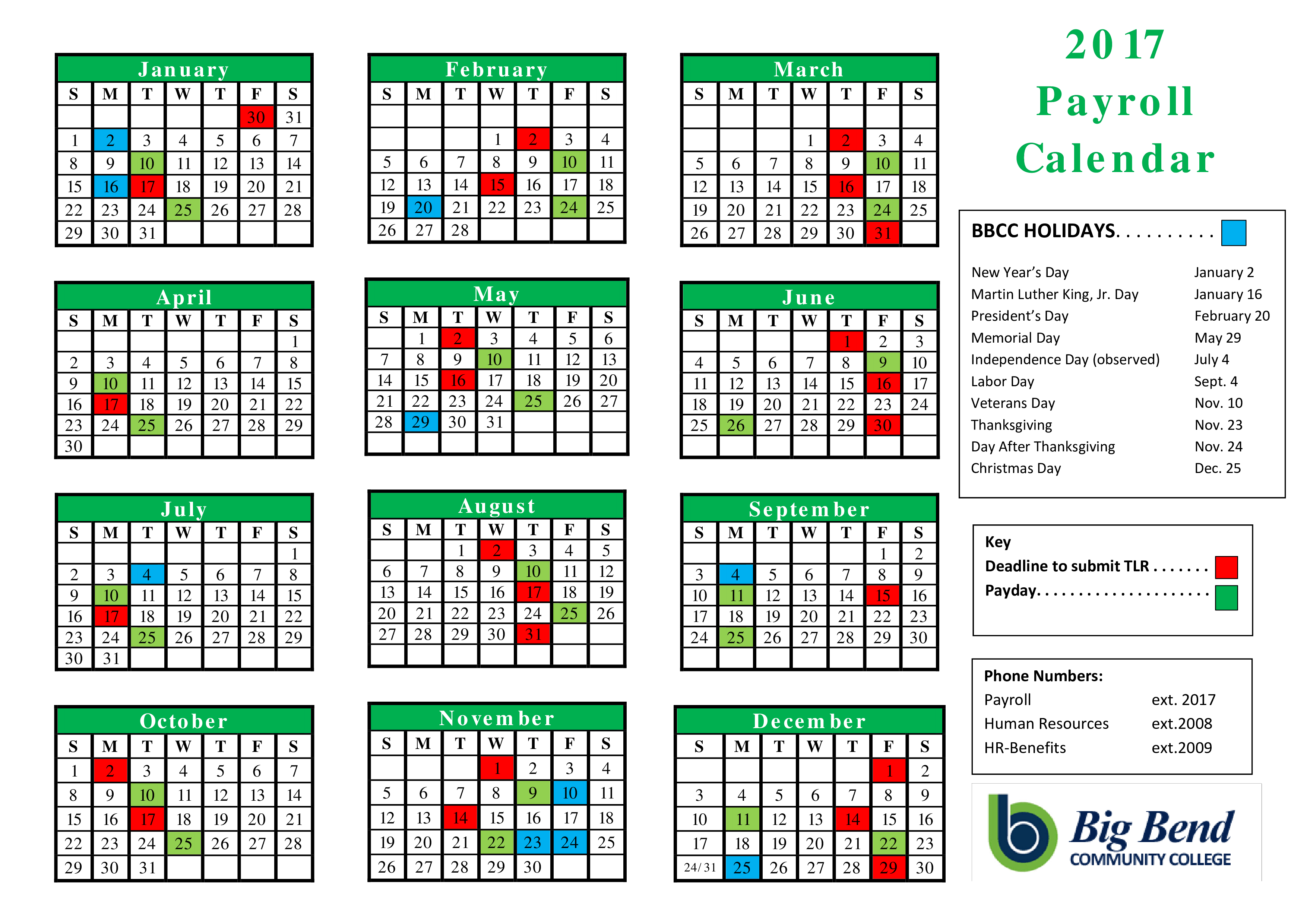

- Payroll Calendar

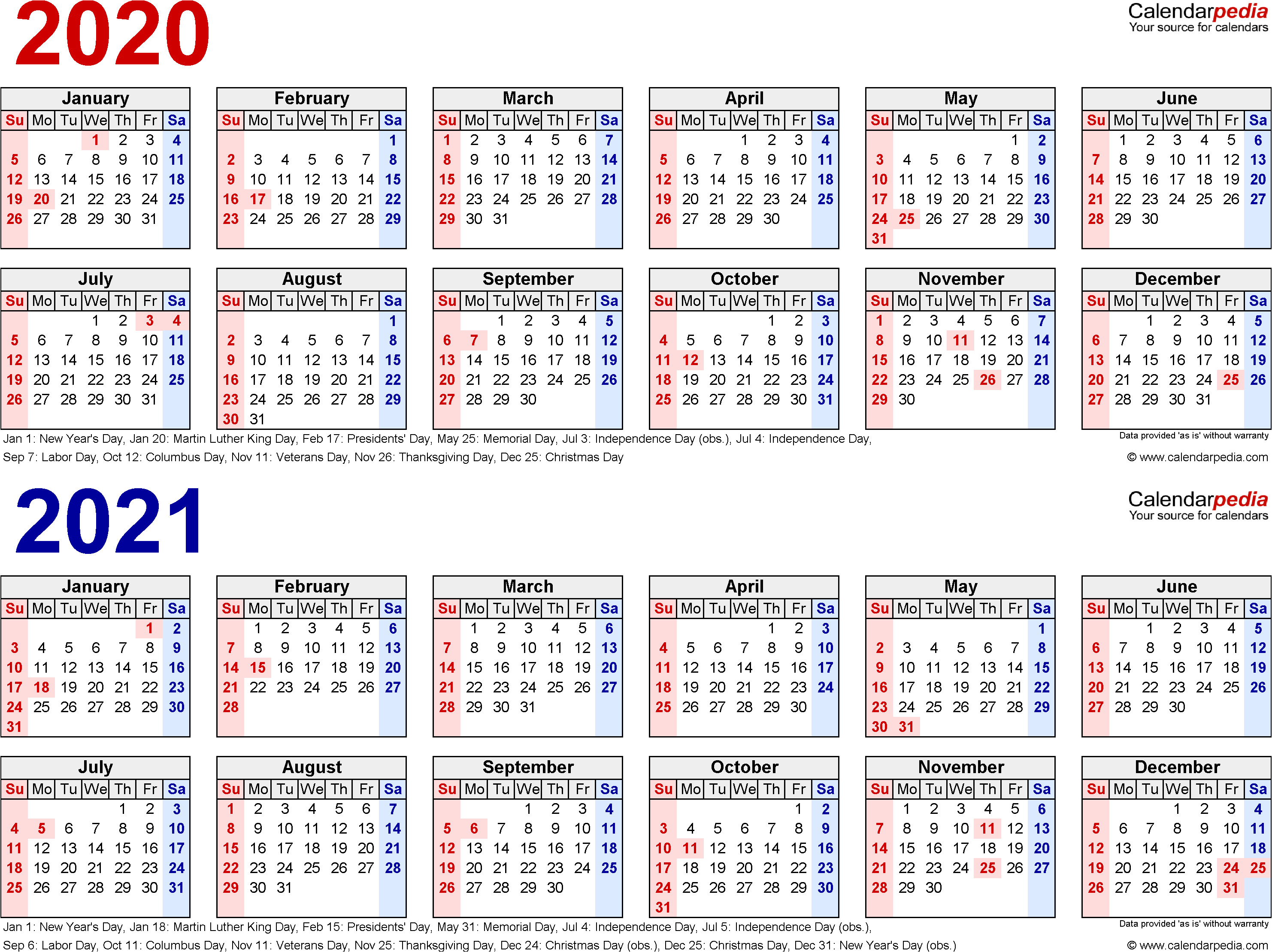

- Biweekly Payroll Calendar for 2025

- Benefits of Using a Biweekly Payroll Calendar

- Considerations for Creating a Biweekly Payroll Calendar

- Payroll Processing Timeline

- Common Payroll Errors

- Payroll Software

- Legal Considerations for Payroll

- Best Practices for Payroll Management: 2025 Biweekly Payroll Calendar

- Payroll Outsourcing

- FAQ

The 2025 biweekly payroll calendar is an indispensable tool for businesses and employees alike. It provides a clear and concise overview of pay periods throughout the year, ensuring that employees are paid on time and accurately. This comprehensive guide will delve into the intricacies of biweekly payroll calendars, exploring their benefits, considerations, and best practices.

Biweekly Pay Schedule

A biweekly pay schedule is a payment frequency in which employees are paid every two weeks, or 26 times a year. It differs from other pay frequencies such as monthly (12 times a year), semi-monthly (24 times a year), or weekly (52 times a year).

Example of a Biweekly Pay Schedule

Here’s an example of a biweekly pay schedule:

- Pay Period 1: January 1 – January 14

- Payday: January 15

- Pay Period 2: January 15 – January 28

- Payday: January 29

- …

- Pay Period 26: December 16 – December 31

- Payday: January 2

Payroll Calendar

A payroll calendar is a document that Artikels the dates on which employees will be paid. It is used to ensure that employees are paid on time and that the company has sufficient funds available to cover payroll expenses.

The key components of a payroll calendar include:

- The pay period start and end dates

- The pay date

- The amount of pay

Here is an example of a payroll calendar for 2025:

| Pay Period Start Date | Pay Period End Date | Pay Date | Amount of Pay |

|---|---|---|---|

| January 1, 2025 | January 14, 2025 | January 15, 2025 | $1,000 |

| January 15, 2025 | January 28, 2025 | January 29, 2025 | $1,000 |

| January 29, 2025 | February 11, 2025 | February 12, 2025 | $1,000 |

Biweekly Payroll Calendar for 2025

This comprehensive calendar Artikels the biweekly pay periods for 2025, ensuring timely and accurate payroll processing throughout the year.

To enhance clarity and readability, the calendar is presented in a tabular format, providing a clear overview of each pay period’s start and end dates.

Biweekly Pay Periods, 2025 biweekly payroll calendar

| Pay Period | Start Date | End Date |

|---|---|---|

| 1 | January 1, 2025 | January 14, 2025 |

| 2 | January 15, 2025 | January 28, 2025 |

Benefits of Using a Biweekly Payroll Calendar

Using a biweekly payroll calendar offers numerous advantages for both businesses and employees. It ensures timely and organized payroll processing, streamlines financial planning, and enhances transparency and communication.

For businesses, a biweekly payroll calendar provides:

- Improved cash flow management:Predictable payroll expenses allow businesses to forecast cash flow and allocate funds effectively.

- Simplified budgeting:Regular pay dates make it easier for businesses to plan expenses and manage budgets.

- Enhanced compliance:Adhering to a consistent payroll schedule helps businesses comply with labor laws and regulations.

For employees, a biweekly payroll calendar offers:

- Predictable income:Regular paydays ensure a consistent flow of income for employees to manage their finances and meet their financial obligations.

- Improved budgeting:Knowing the exact pay dates allows employees to plan their expenses and avoid financial surprises.

- Increased transparency:A clear payroll calendar provides employees with visibility into their pay schedules and helps them plan accordingly.

Considerations for Creating a Biweekly Payroll Calendar

Creating a biweekly payroll calendar requires careful planning to ensure timely and accurate payments to employees. Several factors need to be considered to create an effective and compliant payroll schedule.

Impact of Holidays and Weekends

Holidays and weekends can disrupt the regular biweekly pay schedule. Determine which holidays will be paid and how they will affect the pay date. If a payday falls on a holiday or weekend, consider paying employees on the preceding business day or the following business day.

Handling Paydays that Fall on Holidays or Weekends

To avoid confusion and delays, establish clear guidelines for handling paydays that fall on holidays or weekends. Communicate the policy to employees and ensure they understand the process.

- Pay on Preceding Business Day:Pay employees on the last business day before the holiday or weekend.

- Pay on Following Business Day:Pay employees on the first business day after the holiday or weekend.

- Pay on Alternative Schedule:Establish a separate pay schedule for holidays and weekends to ensure timely payments.

Payroll Processing Timeline

Payroll processing typically follows a structured timeline to ensure timely and accurate payments to employees. In the case of biweekly payroll, the processing period covers two weeks.

Payroll Processing Steps

The biweekly payroll processing timeline typically involves the following steps:

- Timekeeping and Data Collection:The process begins with collecting timekeeping data from employees, either manually or through an automated system. This data includes hours worked, overtime, and any applicable deductions.

- Payroll Calculation:Once the timekeeping data is collected, the payroll team calculates each employee’s gross pay based on their hourly rate or salary. Deductions, such as taxes, insurance premiums, and retirement contributions, are then subtracted to determine the net pay.

- Payroll Review and Approval:Before finalizing the payroll, it undergoes a review and approval process to ensure accuracy and compliance with regulations. This typically involves checking for errors, verifying deductions, and obtaining necessary approvals from management.

- Payroll Distribution:Once the payroll is finalized, it is distributed to employees through direct deposit, checks, or a combination of both. The payment date is usually within a few days of the end of the pay period.

- Payroll Reporting:After the payroll is distributed, the payroll team prepares various reports, such as payroll summaries, tax reports, and employee earnings statements. These reports are used for accounting, tax compliance, and employee record-keeping.

Common Payroll Errors

Payroll errors can lead to incorrect payments, penalties, and legal issues. Understanding and preventing these errors is crucial.Common payroll errors include:

Miscalculation of Hours

Incorrectly calculating regular, overtime, or holiday hours.

Causes

For your reference, the 2025 biweekly payroll calendar is available online. If you’re also interested in the academic calendar, you can check out the aacps calendar 2024-2025 for more information. Don’t forget to bookmark the 2025 biweekly payroll calendar for easy access throughout the year.

Inaccurate timekeeping, manual errors, or misinterpretation of policies.

Consequences

Underpayment or overpayment of employees.

Tax Withholding Errors

Applying incorrect tax rates or withholding too much or too little.

Causes

Misinterpretation of tax laws, incorrect employee information, or software errors.

Consequences

Tax penalties, employee overpayment or underpayment, and potential IRS audits.

Payroll Deductions Errors

Mistakes in calculating or deducting employee benefits, such as health insurance or retirement contributions.

Causes

Inaccurate employee elections, manual errors, or software glitches.

Consequences

Incorrect employee deductions, underfunding of benefits, or overpayment to employees.

Payment Errors

Issuing payments to incorrect employees or for incorrect amounts.

Causes

Manual errors, software malfunctions, or fraudulent activities.

Consequences

Employee frustration, financial losses, and potential legal liabilities.

Compliance Errors

Failing to adhere to labor laws, such as minimum wage, overtime pay, and recordkeeping requirements.

Causes

Lack of knowledge, outdated policies, or deliberate non-compliance.

Consequences

Legal penalties, fines, and damage to company reputation.

Tips for Avoiding Payroll Errors

- Implement accurate timekeeping and payroll processing systems.

- Train payroll staff on tax laws and company policies.

- Regularly review and reconcile payroll records.

- Conduct payroll audits to identify and correct errors.

- Outsource payroll to a reputable provider to minimize errors and ensure compliance.

Payroll Software

Payroll software is a computer program that helps businesses manage their payroll processes. It can automate tasks such as calculating employee pay, withholding taxes, and printing paychecks.

There are many different payroll software options available, so it’s important to compare them before choosing one for your business. Some of the factors to consider include:

- The number of employees you have

- The complexity of your payroll process

- Your budget

- The features that are important to you

Once you’ve considered these factors, you can start narrowing down your options. Here are a few of the most popular payroll software options:

- ADP Workforce Now

- Paychex Flex

- Gusto

- Intuit QuickBooks Payroll

- Zenefits

These are just a few of the many payroll software options available. By comparing the features and prices of different options, you can choose the one that’s right for your business.

The 2025 biweekly payroll calendar is an indispensable tool for businesses and individuals alike. It helps in planning payroll schedules and ensuring timely payments. If you need to refer to specific dates, such as holidays, you can check out the november 2025 calendar with holidays.

This resource provides a comprehensive overview of the month, including federal and state holidays. By aligning your payroll calendar with these dates, you can avoid any potential disruptions or delays in payments.

Legal Considerations for Payroll

Managing payroll involves legal obligations and compliance with established regulations. Understanding these requirements is crucial to ensure accurate and timely payroll processing.

Payroll laws vary depending on the jurisdiction, but generally cover aspects such as minimum wage, overtime pay, paid time off, and deductions for taxes and benefits.

Payroll Taxes and Withholding

Payroll taxes are mandatory deductions from employee earnings, primarily for funding social security, Medicare, and unemployment insurance programs. Employers are responsible for withholding these taxes from employee paychecks and remitting them to the relevant tax authorities.

In addition to payroll taxes, employers may also withhold other amounts from employee earnings, such as for health insurance, retirement plans, or garnishments. These deductions must be authorized by the employee and comply with applicable laws and regulations.

Best Practices for Payroll Management: 2025 Biweekly Payroll Calendar

Effective payroll management is crucial for businesses to ensure accurate and timely payments to employees. By implementing best practices, organizations can optimize the payroll process, enhance accuracy, and improve efficiency.

Here are some key best practices for managing payroll effectively:

Automate Payroll Processes

Automating payroll processes, such as calculations, deductions, and tax filings, can significantly reduce manual errors and save time. Payroll software can streamline these tasks, ensuring accuracy and compliance.

Establish Clear Payroll Policies

Developing clear and comprehensive payroll policies helps employees understand their compensation and benefits. It also provides guidelines for payroll processing, including pay dates, deductions, and overtime rules.

Train Payroll Staff

Providing proper training to payroll staff is essential for ensuring they have the knowledge and skills to handle payroll effectively. Training should cover topics such as payroll calculations, tax laws, and compliance regulations.

Regularly Review and Audit Payroll

Regularly reviewing and auditing payroll records helps identify errors and discrepancies. This ensures that employees are paid accurately and that the organization is compliant with tax and labor laws.

Use Technology to Enhance Efficiency

Leveraging technology, such as cloud-based payroll systems and mobile apps, can improve efficiency and accessibility. Employees can access their payroll information and submit time sheets remotely, while managers can approve and process payroll from anywhere.

Foster a Culture of Accuracy

Creating a culture of accuracy within the payroll department is essential. This involves encouraging employees to verify their information and report any errors promptly. Regular training and clear communication can help foster this culture.

Payroll Outsourcing

Payroll outsourcing is the process of delegating payroll responsibilities to a third-party provider. This can be a cost-effective and efficient way to manage payroll, but it’s important to weigh the benefits and drawbacks before making a decision.

Some of the benefits of payroll outsourcing include:

- Reduced costs: Payroll outsourcing can save businesses money by eliminating the need for in-house payroll staff and software.

- Increased efficiency: Payroll outsourcing can help businesses streamline their payroll processes and improve accuracy.

li>Improved compliance: Payroll outsourcing providers can help businesses stay up-to-date on payroll regulations and ensure that they are in compliance.

Some of the drawbacks of payroll outsourcing include:

- Loss of control: When you outsource payroll, you give up some control over the process. This can be a concern for businesses that want to maintain tight control over their finances.

- Security risks: Payroll outsourcing providers have access to sensitive employee data. It’s important to choose a provider that has a strong security record.

- Lack of customization: Payroll outsourcing providers typically offer standardized services. This may not be a good fit for businesses that have unique payroll needs.

Types of Payroll Outsourcing Services

There are a variety of payroll outsourcing services available, including:

- Basic payroll processing: This service includes calculating wages, withholding taxes, and issuing paychecks.

- Full-service payroll: This service includes everything in basic payroll processing, plus additional services such as payroll tax filing, garnishments, and direct deposit.

- HR outsourcing: This service includes payroll processing, plus additional HR services such as benefits administration, employee relations, and recruiting.

Choosing a Payroll Outsourcing Provider

When choosing a payroll outsourcing provider, it’s important to consider the following factors:

- Experience: How long has the provider been in business?

- Reputation: What is the provider’s reputation in the industry?

- Services: What services does the provider offer?

- Cost: How much does the provider charge for its services?

- Security: What security measures does the provider have in place?

It’s also important to get references from other businesses that have used the provider’s services.

FAQ

What is the difference between a biweekly and semi-monthly pay schedule?

A biweekly pay schedule pays employees every two weeks, while a semi-monthly pay schedule pays employees twice a month, usually on the 15th and the last day of the month.

How can a biweekly payroll calendar benefit my business?

A biweekly payroll calendar helps businesses stay organized and ensures that employees are paid on time. It also allows businesses to plan for payroll expenses and avoid penalties for late payments.